California Solar Incentives, Tax Credits, and Rebates for 2025

Can switching to solar power really save you money in California? It can! A list of local, state, and federal incentives offers discounts for solar installation and battery storage systems. From tax credits to installation rebates, there are lots of options to save big on energy efficiency and self-generated power.

This blog covers some of the most commonly used programs, including:

- Investment Tax Credit (ITC)

- Inflation Reduction Act (IRA)

- Local Rebates

- DAC-SASH

- Net Energy Metering Programs

- Residential Clean Energy Credit

- PACE Financing

- Solar Tax Rebate California & Other Incentives

- Federal Solar Tax Credit

- Qualifying Expenses for Solar Tax

INVESTMENT TAX CREDIT (ITC)

In 2005, the Investment Tax Credit was first established when the Energy Policy Act was enacted. It has reached a scheduled expiration date several times since then, but it has been so popular and so successful that Congress has continued to extend the expiration date.

The most recent continuation of the program is part of the Inflation Reduction Act and continues to offer a 30% tax credit for the total installation cost of a home solar system. This significant California solar incentive ensures homeowners can maximize savings when switching to clean energy.

INFLATION REDUCTION ACT (IRA)

The Inflation Reduction Act extended the residential Investment Tax Credit and made some substantial changes. Under the new, revitalized program, homeowners can still get 30% of the installation costs of solar panels as a tax credit and carry over any unused credit to future tax years.

For example, a $30,000 solar array would give you a tax credit of $9,000, but if you don't owe that much in federal income taxes for the installation year, you can apply the credit to reduce your taxes owed to $0 for the year and bank the rest to be used the next year.

To qualify for the tax credit, you must own the solar panels, so leasing programs aren't an option. You must have taxable income. The tax credit won't reduce your tax amount to a negative, so you can't cash out the money you haven't paid in. And the solar panels must be installed at your primary or secondary residence.

As the tax credit phases out, the credit amount drops to 26% for systems being installed through 2033 and to 22% for systems installed in 2034. It completely expire in 2035 unless Congress chooses to extend the program further.

The IRA also added battery storage systems to the tax credit, allowing up to 30% of the cost of purchase and installation as a tax credit, provided the system is exclusively charged using solar power. This is a fantastic opportunity for those seeking a California solar tax credit.

LOCAL REBATES

ACTIVE SOLAR ENERGY SYSTEM PROPERTY TAX EXCLUSION

California offers homeowners who install a solar power array an exclusion for the array from their property tax assessment. It's not an exemption, but it does mean that the addition of solar power won't be included in the property's assessed value for tax purposes. This allows homeowners to add solar without worrying about increasing their property tax bills.

SELF-GENERATION INCENTIVE PROGRAM

The SGIP is generally acknowledged as the best incentive to install battery storage for a solar array. It offers up to $0.25 per watt-hour of installed storage or $200 per kWh battery installed. This one-time credit helps offset the installation costs for power storage.

The SGIP has also added Equity and Equity Resiliency levels to the program for low-income families. It offers a higher rebate amount to reduce the installation cost to nearly or entirely free. Homeowners in qualifying areas can receive up to $1,000 per kWh of battery storage installed, a 4 times increase over the standard SGIP.

|

Storage Type |

Rebate Amount |

|

Small Residential Storage |

$200 per kWh |

|

Residential Storage Equity |

$800 per kWh |

|

Equity Resiliency |

$1,000 per kWh |

This program, which Californian homeowners can access, along with others like the solar tax rebate, makes solar adoption more accessible and affordable.

DAC-SASH

DAC-SASH is a program that helps offset solar installation costs through property tax credits. Eligible homeowners can receive a rebate of up to $3 per watt for installed solar panels or approved solar-powered devices. This program is aimed at low-income families and does have fairly strict eligibility requirements. You must:

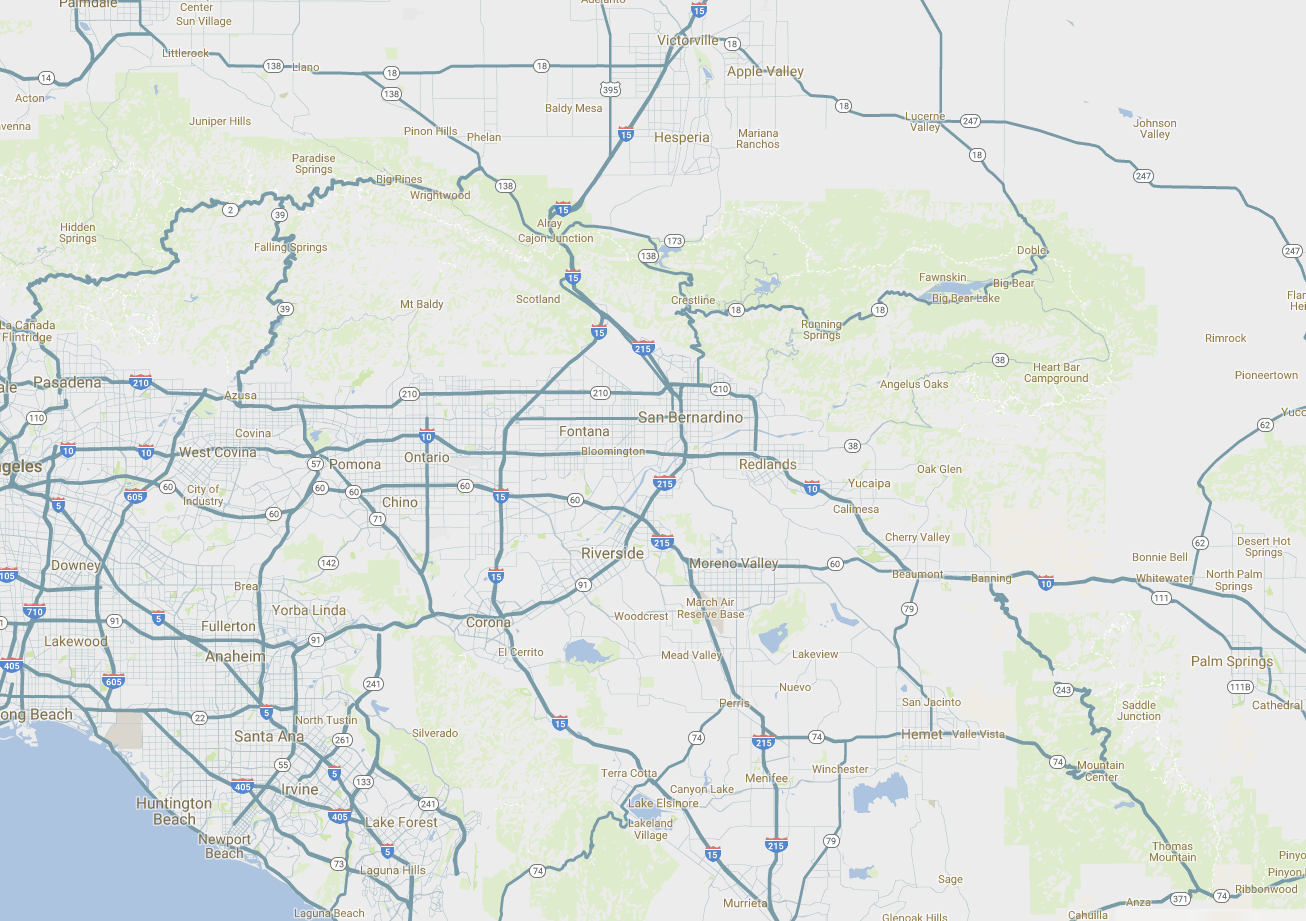

1. Own and live in the home you're seeking DAC-SASH funds for.2. Be a customer of Pacific Gas & Electric (PG&E), Southern California Edison (SCE), or San Diego Gas & Electric (SDG&E).

3. Already enrolled or eligible to enrol in an income-based CARE or FERA utility bill program.

4. Your property must also be located in a qualified area.

NET ENERGY METERING PROGRAMS

Net metering, or net energy metering, is a great way for solar panel owners to save money by generating their own electricity. In California, it allows property owners to sell back unused electricity from their solar panels in exchange for bill credits.

Previously, new solar panel owners were enrolled in NEM 2.0, which locked in a set rate for excess energy—close to what customers paid for electricity—for 20 years. This helped many homeowners see a return on their solar investment in as little as six years.

However, NEM 2.0 ended on April 13, 2023. Homeowners who submitted a completed interconnection application before this date can still participate and receive the 20-year rate guarantee, as long as their solar installation is completed within three years. Anyone who missed the deadline is now under NEM 3.0, which provides significantly lower bill credits for excess energy.

RESIDENTIAL CLEAN ENERGY CREDIT

The Residential Clean Energy Credit allows homeowners to claim a 30% tax credit for solar installations and battery storage systems. On average, homeowners can save up to $9,000 when applying this credit to a $30,000 solar system installation. This initiative complements other solar incentives and rebates available to Californian homeowners looking to reduce their energy costs.

PACE FINANCING

Property Assessed Clean Energy (PACE) financing allows homeowners to fund their solar installations through property taxes. This financing option provides a low-interest, long-term repayment structure, making solar systems more accessible. Homeowners can also combine PACE financing with the Solar Tax Rebate California to maximize savings on their clean energy investment.

SOLAR TAX REBATE CALIFORNIA & OTHER INCENTIVES

To help offset the cost of solar panel installations, homeowners can take advantage of several financial benefits, including the Solar Tax Rebate California and other California solar incentives. These programs make solar energy more affordable and accessible.

FEDERAL SOLAR TAX CREDIT

Homeowners can claim the federal solar tax credit once per solar installation. It covers solar panels, inverters, batteries, and installation costs. For a typical 5 kW system costing $20,000, the tax credit would be $6,000.

QUALIFYING EXPENSES FOR SOLAR TAX

Qualifying expenses for the California solar tax credit include all essential components and services related to installing and maintaining a solar energy system. These include:

1. Solar Panels: The primary component of any solar installation, eligible for tax credit.2. Solar Batteries: Necessary for energy storage, allowing homeowners to maximize their solar system’s efficiency.

3. Installation Labor: Costs for professional installation, including mounting and wiring, are fully covered.

4. Inspections: Pre- and post-installation inspections ensure compliance with safety and performance standards and are also tax-deductible.

By claiming these qualifying expenses, California homeowners can take full advantage of solar tax rebates and California solar tax credits, significantly reducing their initial investment in clean energy solutions. The combination of solar incentives, including the solar tax rebate California offers, helps make the switch to renewable energy more affordable.

WANT TO GET STARTED ON YOUR SOLAR INSTALLATION TODAY?

Let us help. At Burgeson's, we put honesty and integrity first, which is why we always offer honest opinions about solar viability for your home.

If you have questions about how much you could save with solar panels and battery backup, call us at 909-792-2222 to request a free estimate and get honest and upfront pricing.