There’s no getting around it: home service projects can be expensive. Installing a new HVAC system, replacing a sewer line, or rewiring your home can easily cost thousands of dollars.

The good news? You can take advantage of some financing options that can help you pay for these valuable services.

In this blog, we’ll share:

- How to finance your home service project

- Money-saving tips to consider as your plan for your home improvement project

Want to know what financing options are available for your home service project? Contact us today for more information.

How to finance your home service project

As a homeowner, you have several options when it comes to paying for home service projects. Some homeowners choose to use their savings to cover the upfront costs, but that’s not always an option.

Others choose to use credit cards to pay for home improvements. But credit card interest rates can become overwhelming if the balance isn’t paid off quickly. You can also apply for a home equity loan or obtain a home equity line of credit (HELOC), but these financing options often have higher fees and require you to use your home as collateral.

One consumer-friendly financing option that avoids some of those risks is a home improvement loan. A home improvement loan is offered by a home service company, credit union, or bank. The terms of the loan, such as the interest rate, are determined by your credit score and the scope of the project.

Many home improvement loans offer competitive interest rates, are easy to obtain, and are unsecured (meaning you don’t have to use your home as collateral), which makes them a popular financing option among homeowners.

Financing options with Burgeson’s

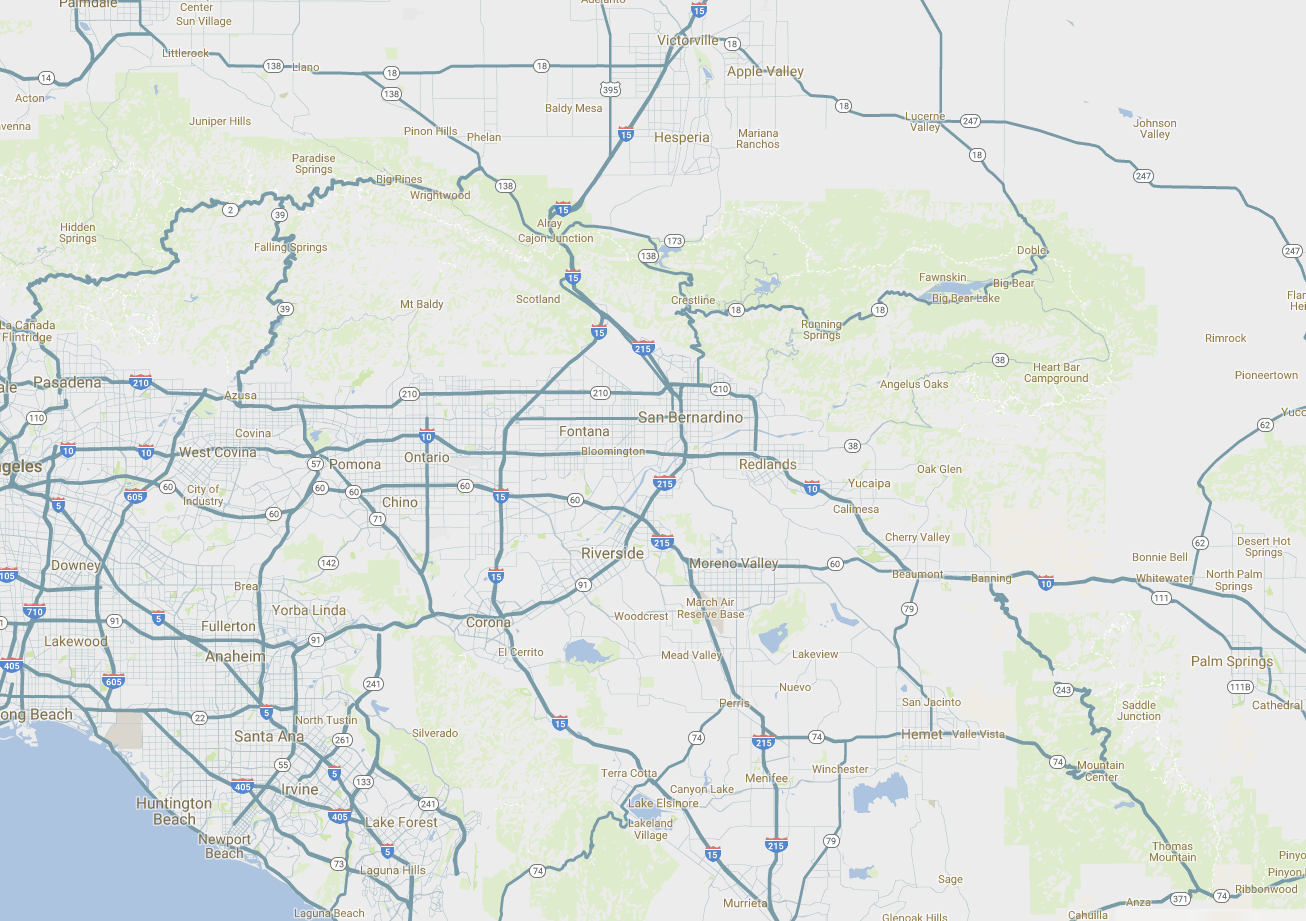

At Burgeson’s, we offer flexible loan options based on the type of home service project you need. In fact, we offer a financing option for any project over $500—whether it’s an installation or repair for HVAC, plumbing, electrical, and/or solar.

Below are some of the financing options we offer year-round:

- For HVAC, electrical or plumbing loans above $500, we offer 12 months of deferred interest (O.A.C.) with minimum monthly payments.

- For HVAC, electrical or plumbing loans above $1,000, we offer 18 months with deferred interest and a 5-year fixed interest rate at 6.99% (O.A.C.).

- For HVAC, electrical or plumbing loans above $3,000, we offer a 15-year fixed interest rate at 7.99% (O.A.C.).

- For solar panel installations only, we offer a 25-year fixed interest rate at .99% (O.A.C.).

You can learn more about the financing services we offer by visiting our financing details page.

Examples of home improvement projects that are eligible for our loans include:

- Replacing an old air conditioner, furnace or heat pump

- Whole-home plumbing repiping

- Whole-home electrical rewiring

- Installing a whole-home generator

- Installing solar panels

- Installing a water treatment and conditioning system

- And more

You can learn more about all the services we offer by visiting our heating, cooling, electrical, plumbing, and solar service pages.

Money-saving tips for home improvement projects

As you plan for your next home upgrade, consider these money-saving tips:

Tip #1: Research the cost factors for the project

Most home service projects have several factors that will influence the overall cost of the project. Researching these factors, in the beginning, will help you establish a budget and be more informed as you work with the contractor who carries out the project.

We’ve written some blogs that explain the different cost factors for common home service projects:

- How Much Does it Cost to Install a Whole-Home Generator in Southern California?

- How Much Does it Cost to Replace a Sewer Line in the Southern California Area?

- How Much Does it Cost to Install a Heat Pump in the Southern California Area?

- How Much Does it Cost to Install a Water Heater in the Southern California Area?

- How Much Does it Cost to Install Solar Panels in Southern California?

Tip #2: Look for special deals or promotions

Most home service contractors offer seasonal discounts or promotions throughout the year. Keep an eye out for these discounts, as they can reduce the upfront costs of your home service project.

Tip #3: Investigate rebates and tax credits

Finally, you’ll want to see if there are any rebates or tax credits available for your home upgrade, as these can also reduce the overall cost of the project.

Rebates can be offered by utility companies or equipment manufacturers. Tax credits are offered by local, state, or national governments to incentivize investments in energy-efficient and environmentally-friendly equipment.

You can do some research online about what rebates your local utility company offers and what tax credits are available to you. The home service contractor you hire for the project should also be able to inform you of any equipment rebates and tax credits you qualify for.

Want to speak with a home service professional about financing your next home improvement project?

Call Burgeson’s (909-792-2222) to request an appointment with one of our home service specialists. We will provide you with upfront pricing and honest financing recommendations based on your budget and the scope of the project.

You can learn more about all the home services we offer by visiting our heating, cooling, electrical, plumbing, and solar service pages.